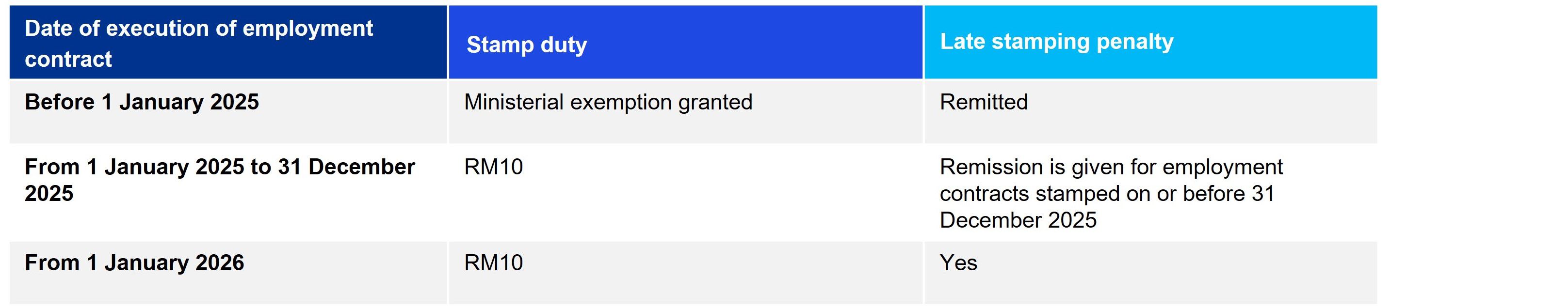

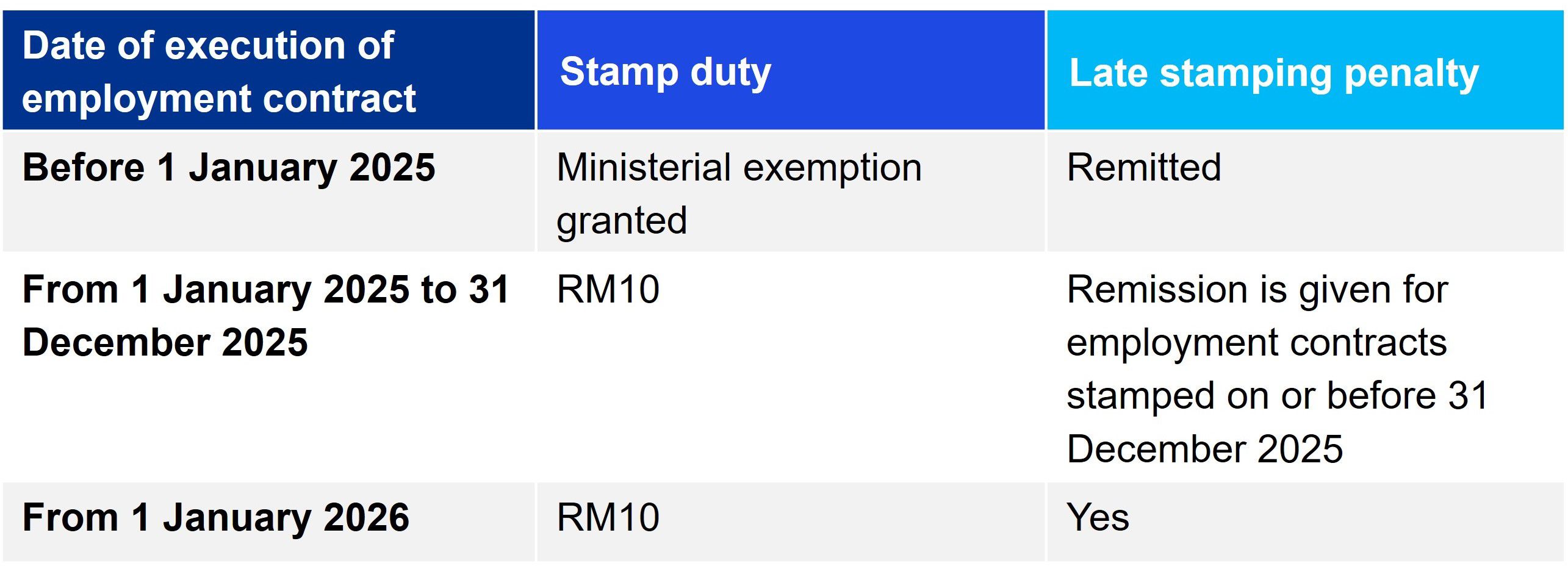

Stamp Duty Exemption for Employment Contracts Executed Before 1 January 2025

Employment contracts are instruments chargeable with stamp duty at RM10 per instrument pursuant to Item 4, First Schedule of the Stamp Act 1949. Recent stamp duty audit and compliance operations by the Malaysian Inland Revenue Board revealed that one of the major non-compliance revolves around unstamped employment contracts.

In view of the above, the Ministry of Finance has made the following decision to alleviate the compliance burden on employers:

Petaling Jaya Office

Soh Lian Seng

Partner - Head of Tax and Tax Dispute Resolution

[email protected]

+ 603 7721 7019

Ng Sue Lynn

Partner - Head of Indirect Tax

[email protected]

+ 603 7721 7271

Tai Lai Kok

Partner - Head of Corporate Tax

[email protected]

+ 603 7721 7020

Bob Kee

Partner - Head of Transfer Pricing

[email protected]

+ 603 7721 7029

Long Yen Ping

Partner - Head of Global Mobility Services [email protected]

+ 603 7721 7018

Outstation Offices

Penang

Evelyn Lee

Partner

[email protected]

+603 7721 2399

Ipoh

Crystal Chuah Yoke Chin

Associate Director

[email protected]

+603 7721 2714

Kuching & Miri

Regina Lau

Partner

[email protected]

+603 7721 2188

Kota Kinabalu

Titus Tseu

Executive Director

[email protected]

+603 7721 2822

Johor

Ng Fie Lih

Partner

[email protected]

+603 7721 2514